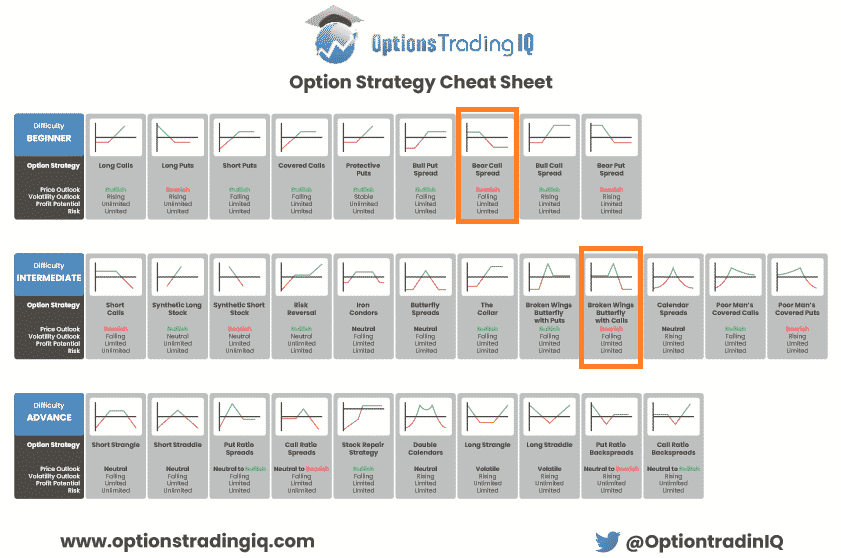

Option Strategy Cheat Sheet Two Free Downloads

Brochures & Literature. Characteristics and Risks of Standardized Options (provided by OCC) Also known as the options disclosure document (ODD), it explains the characteristics and risks of exchange traded options. Prior to buying or selling an option, an investor must receive a copy of this document. Expiration Calendar s (published yearly)

Options Strategies Cheatsheet. Here is a ready referral to Option… by Sensibull Medium

Options Clearing Corporation

The Wheel Strategy The Wheel Options Strategy Guide — HaiKhuu Trading

Investor Services. The Investor Services Team is available via email or chat on all trading days from 8 a.m. to 4 p.m., CST. Our experienced options professionals are dedicated to providing information and education about U.S. exchange-listed options as well as all other products cleared by OCC.

10 Options Strategies Every Investor Should Know

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-c1aed6a1ee3545068e2336be660d4f81.png)

Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting The Options Clearing Corporation, 125 S. Franklin Street, Suite 1200, Chicago, IL 60606.

[DOWNLOAD] The StepbyStep "Ultimate" Options Strategy Guide [PDF] {15MB} Premium Trading

OIC is an industry resource provided by OCC that offers trustworthy education about the benefits and risks of exchange-listed options. Since 1992, OIC has been dedicated to increasing the awareness, knowledge and responsible use of options by individual investors, financial advisors and institutional managers. Download Now.

OCC options volume charts FUTURES OPTIONS CRYPTOS

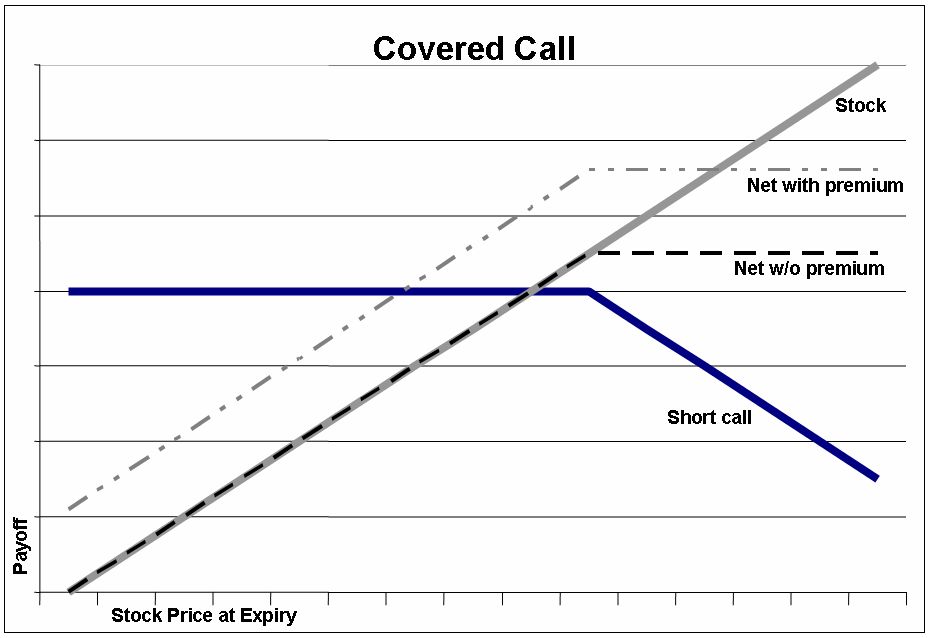

Strategies you might consider: Protective Put = Long stock + Long Put. Purchase the right to sell shares at the strike price of the put option which protects from a share price decline below that level. Collar = Long stock + Long Put + Short Call. Purchase a put option and simultaneously sell a call option to offset the cost while accepting.

Ultimate Options Strategy Guide Option Alpha [Download]

Unscheduled Market Closings Guide. The purpose of this guide is to advise external stakeholders (exchanges, members, etc.) how OCC intends to proceed in the event of an unscheduled closing. All plans discussed are subject to revision if circumstances dictate alternative actions. Download now (PDF)

OCC charts FUTURES OPTIONS CRYPTOCURRENCIES

OCC publishes another document, Taxes & Investing: A Guide for the Individual Investor, which can serve to enlight-en both you and your tax advisor on option strategies and the issue of taxes.This booklet can also be obtained from your brokerage firm or by either calling 1-888-OPTIONS or visiting www.888options.com.

OIC on Twitter "We go together! Stocks and Options, that is. New OCC Learning course, “Options

The Options Industry Council (OIC) was created to educate the investing public and brokers about the benefits and risks of exchange-traded options. In an effort to demystify this versatile but complex product, OIC conducts seminars, distributes educational software and brochures, and maintains a Web site focused on options education.

Top Option Strategies Poster. Option Trading. Stock Market Etsy Option strategies, Stock

Standardized Options, available to download at www.cboe.com. Copies of this document are also available from your broker or The Options Clearing Corporation (OCC), One North Wacker Drive, Suite 500, Chicago, IL 60606 or by calling 1-888-OPTIONS. The OCC Prospectus contains information on options issued by The Options Clearing Corporation.

Covered Calls for Beginners (Options Trading Strategy Guide) New Trader U

1 Long option positions held in customer accounts of CMs, and not part of various designated spread positions, are excluded altogether from OCC margin calculations for investor protection reasons. The effect of the exclusion is that the value of such options does not get used to collateralize other customers' short positions. 2 The single-factor sub-portfolios consist of all positions (options.

9 TOP OPTIONS STRATEGIES Stock trading strategies, Option strategies, Online stock trading

Options can play a variety of roles in different portfolios. Picking a goal narrows the field of appropriate strategies. Perhaps you want more income from the stocks you own. Maybe you hope to protect the value of your portfolio from a market downturn. No one objective is better than another, just as no one options strategy is better than.

The Complete Guide to Option Strategies PDF Download Read

6 The Bible of Options Strategies 1.1.2 Context Outlook With a Long Call, your outlook is bullish. You expect a rise in the underlying asset price. Rationale To make a better return than if you had simply bought the stock itself. Do ensure that you give yourself enough time to be right; this means you should

Scalping Trading Strategy with a HIGH WIN RATE that works! (OCC Strategy R5 + KDJ) YouTube

1. Sell the put option with a strike price lower than the current stock price. Remember that for option contracts in the U.S., one contract is for 100 shares. So when you see a price of $1.00 for a put, you will receive $100 for one contract. For S&P Futures options, one contract is exercisable into one futures con-.

OCC Strategy R5.1 FMZ

A Guide to Investing With Options. OCC 125 South Franklin Street, Suite 1200 | Chicago, IL 60606. This web site discusses exchange-traded options issued by The Options Clearing Corporation. No statement in this web site is to be construed as a recommendation to purchase or sell a security, or to provide investment advice.

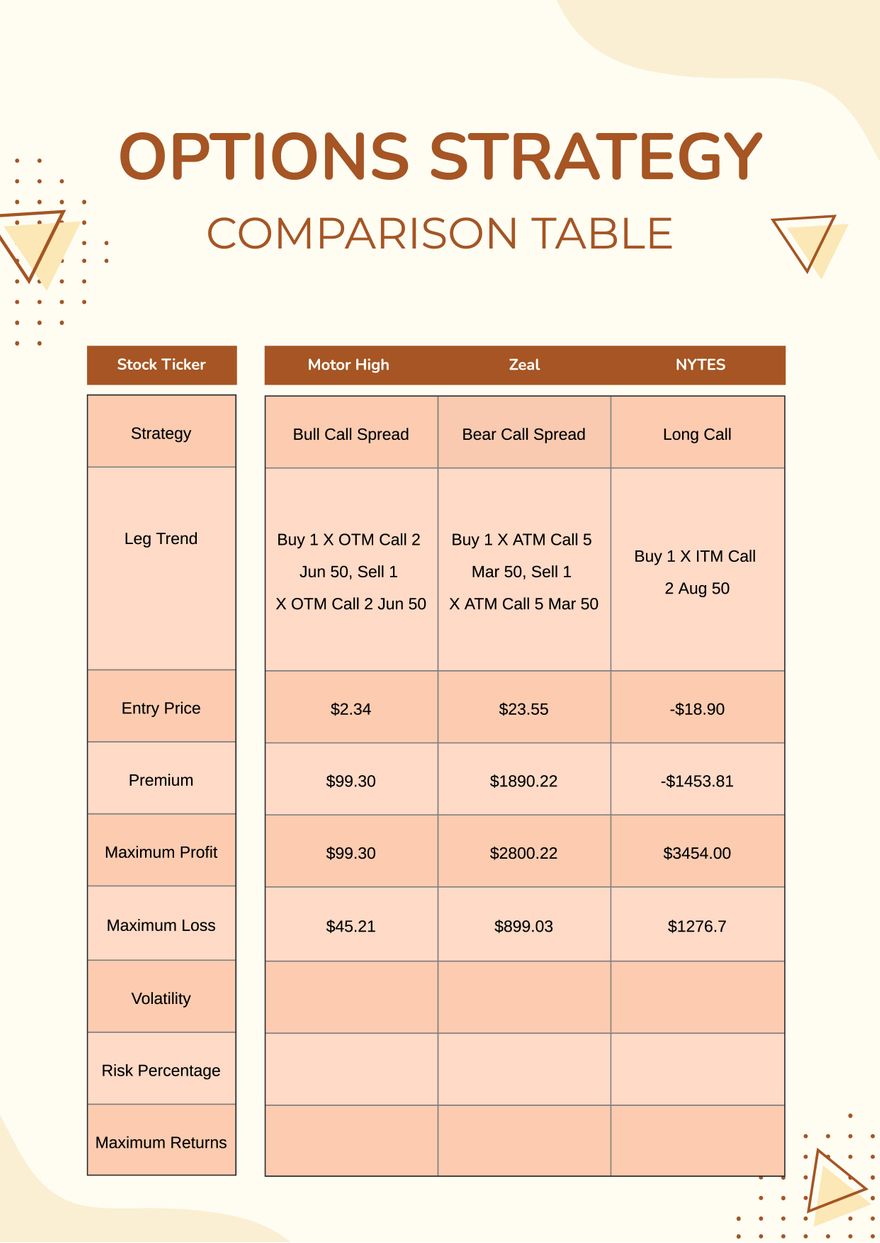

Options Strategy Comparison Table & Chart in Illustrator, Portable Documents Download

OCC helps protect the integrity of the U.S. equity options and futures markets by delivering world-class risk management, clearing and settlement services for options, futures, and securities lending transactions. In its role as guarantor and central counterparty, OCC ensures that the obligations of the contracts it clears are fulfilled.